30 Jan Kauai Market Report Year End 2020

Home Sales on Kauai

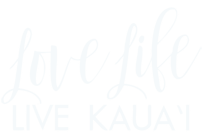

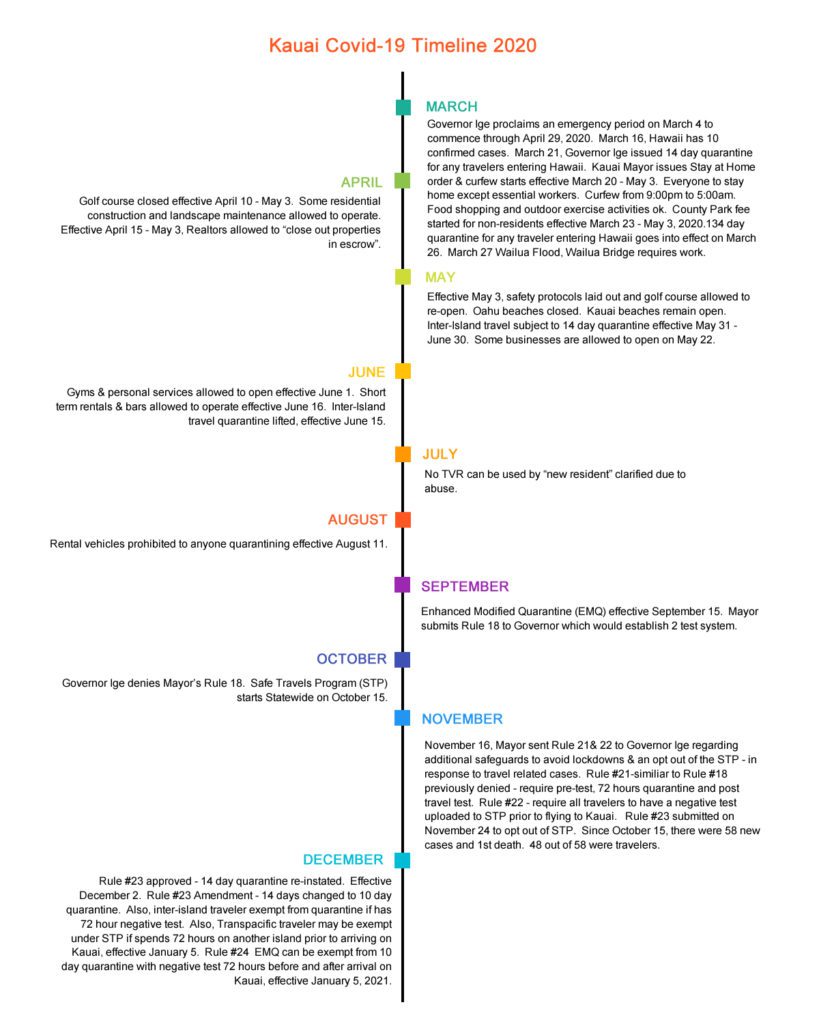

The year ended quite strong for home sales on Kauai. The overall number of homes sold island wide was down by 8%, however, dollar volume was up by 28% and and the median price jumped from $660,000 to $810,000. The only area with double digit decrease in homes sold was Central Lihue and is probably due to lack of inventory. The north shore district ended the year with a 17% increase in units sold and a 99% rise in dollar volume, while the median price for a home was 23% higher than 2019 at $1,357,500.

Over the years, I have witnessed various factors that have influenced the local real estate market such as the United Airlines strike in 1985, the Gulf War and Hurricane Iniki in the 1990’s, and the Financial Crisis of 2007/2008; none of these events had the immediate and significant effect that the corona virus has had.

In 2020, technology and Covid both played pivotal roles in the direction of the real estate market on Kauai. It has been at least a couple decades that tech has allowed people in certain industries to work from home. The ability to work remotely and moving to Kauai is not new, however, in the past it was limited to only those in a position to take advantage of this work model and the process to move was made over a period of time. Usually, the prospective buyer visited Kauai, made the decision to live here, and returned to view homes to purchase.

How Covid Impacted Kauai’s Real Estate Market

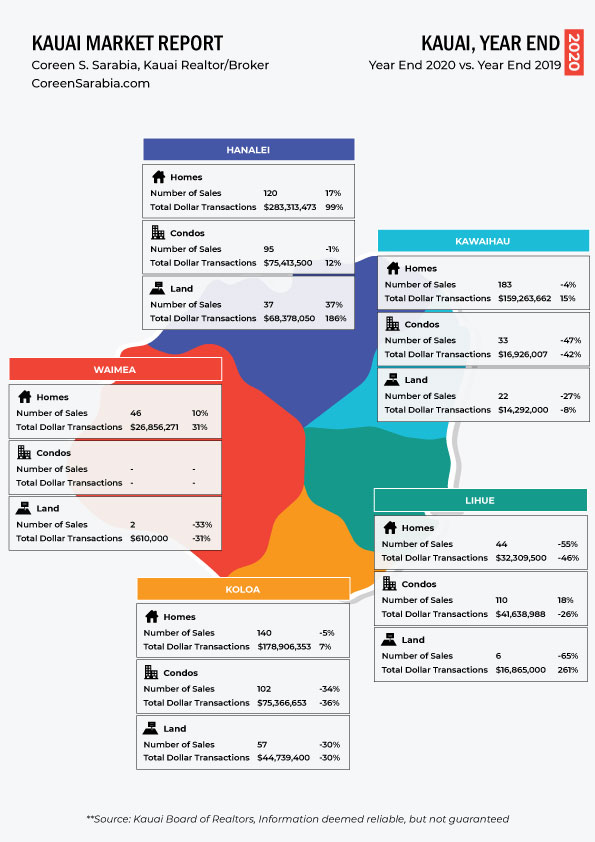

When Covid-19 hit in March, Stay At Home Orders were put into place and only essential activity was allowed. Initially, real estate was deemed non-essential on Kauai and for a period of time Realtors could not work except to carry out necessary duties to “close out properties in escrow.”

Two-week quarantines were imposed to anyone entering the state of Hawaii and as statistics show, second quarter numbers were all in negative double digit territory. Over the next couple of months, it became clear that the world wide pandemic was going to be around for awhile and that it was deadly to the unfortunate humans whose bodies could not fight it.

By summer, the real estate market started to perk up fueled by several elements. First, interest rates remained at historically low levels. Second, stay at home orders on the mainland forced everyone to work remotely. With children being home schooled, entire families did not need to be confined to any one place. Almost overnight it seemed nearly the entire population of the work force now had the work model previously reserved for a select few. Thirdly, with a low number of covid cases, Kauai was viewed as a safe haven from the virus rampaging across the Country. Fourth, by using technology, buyers could navigate the buying process via a number of different remote methods such as FaceTime or Skype. Sight unseen purchases became a way to complete a transaction without having to physically endure a 14 day quarantine. By the third and fourth quarter of the year, evidence of newcomers around the island was noticeable by indicators such as vehicles with out-of-state license plates. It is difficult to gauge exactly how many buyers fit this category and how much of an influence covid had on the out-of-state purchases, but clearly these circumstances played a part in the “recovery” seen at the end of the year.

Condo Sales on Kauai

Condos were the weakest segment of the Kauai real estate market with negative numbers across the majority of the island with double digit declines in units sold and dollar volume. The median price actually ended the year with only a 3% drop. Again, the Hanalei district is the one area that seems to be recovering a bit faster than the rest of the island. Sales activity on the north shore ended the year nearly the same as 2019 with an increase in dollar volume and median price, both by 12%.

Condo recovery will be interesting to watch since the island has a mix of resort type suites and more apartment resident housing depending on the section of the island. On the west side, there is only one apartment-style condo project which is not in a Visitor Destination Area (VDA) and is thus limited to owner occupant or long term rentals while the majority of the condos on the south shore are resort type units. The central Lihue area has a mix of owner occupant/long term rental townhouses to converted hotel rooms to “villa type” luxury high end offerings at Timbers. There was noticeable activity at a particular condo project that actually started in the 2nd quarter of 2020 at the Kauai Beach Resort. Sales of these converted hotel rooms accounted for 23% of all condo transactions in the central district and one purchaser from Idaho bought the majority of the units. East and North Kauai has predominantly vacation rental type units.

Given that a large majority of condos on the island are in resort areas and with tourism suffering, it is not surprising that sales were sluggish. The number of condos currently under contract do not look encouraging with the exception of the east side. With 15 condos under contract in the Wailua area and a total of only 33 that sold in all of 2020, it will be interesting to see what happens with this segment of the real estate market on Kauai.

Land Sales on Kauai

Though there were less number of lots that sold, the dollar volume and median price increased island wide. The year ended with 22% decrease in units sold, however, the dollar volume was up by 33% and the median price went from $468,00 to $571,2500, a 22% jump from 2019.

While the rise in median price was seen in every section of the island, the dollar volume and number of vacant land sold was down except for two areas. The first was the Lihue district where the dollar volume was greatly skewed by a large parcel that closed on Christmas Eve for $15.5 million dollars.

The 420 acres was listed for $19,800,000 and had been on the market since November 2014, a total of 2,195 days. The property has multiple State/County zoning and flood designations and was advertised to offer 1.25 miles of ocean frontage.

The other section of the island that reported significant gains was the north shore area stretching from Kilauea to Haena. The units sold increased by 37% ,the median rose by nearly 22% and the dollar volume jumped by a whooping 186% over 2019. Unlike the one large sale in Lihue, the vacant land that sold in this region of the island was a diverse mix. From off the grid, one acre parcels that sold below $300,000, to Princeville resort lots which sold from $350,000 to $475,000, to acreage starting at over $500,000 to over one million dollars depending on size, terrain and view. The top price paid on the north shore was for nearly 8 acres zoned for 3 houses on an ocean bluff for $12,400,000 and was purchased with cash and proceeds from a 1031 Exchange. Sale prices over $1 million accounted for 38% of the north shore vacant land recordation.

At the end of August, I wrote a blog about the influx of “sight unseen buyers” being noticed on island. Much has happened since then. In the following four months, the Enhanced Modified Quarantine (EMQ) started in September, the Safe Travels Program (STP) started in October, Covid cases increased and Kauai opted out of the STP and the 14 day quarantine was reduced to 10 days. As of January 5, 2021, inter-island travel has eased and transpacific travelers have several options, none of which are as severe as the original 14 day quarantine. With the release and distribution of the covid vaccine, hopefully brighter days are ahead.